Aging is a natural process that everyone goes through, but how we age can be significantly influenced by our daily habits. Staying fit and healthy as we grow older is not just about physical exercise, though that plays a crucial role. Experts emphasize that it's also about focusing on mental well-being, maintaining social connections, and prioritizing good sleep hygiene.

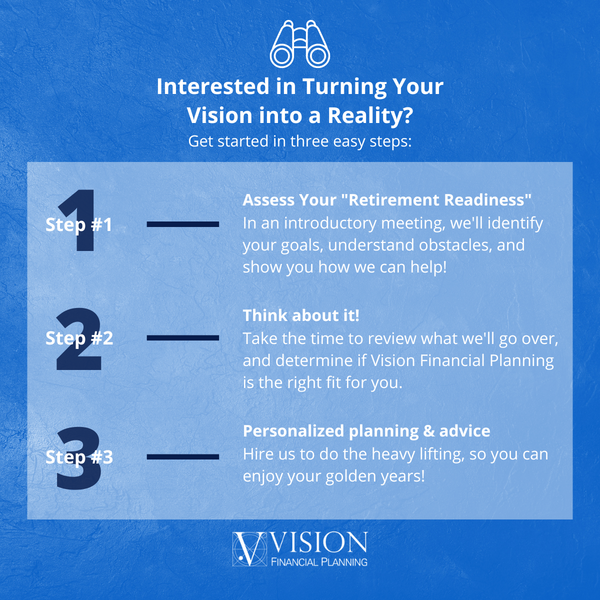

Are you Retirement Ready?

Great question! We define retirement readiness as:

Looking to retire in the next 10 years

Have over $500k in retirement savings

Prioritize sound advice, solid planning, and working with a financial partner

We understand that:

- Planning for retirement on your own can seem daunting, and often stressful.

- Finding the right Financial Advisor to help can be equally difficult

At Vision Financial Planning, we specialize in helping people aged 50+ lower taxes, invest smarter, and maximize income for their “golden years.”