We Believe in Financial Transparency

Financial Advisors and their service costs are notoriously difficult for people to understand.

We want to change that narrative by helping prospective clients like you fully understand what you're getting into, and the real value of what we do.

It only makes sense to hire a financial advisor - or any professional - if the value they provide exceeds the fees being charged. In other words, the time and efforts saved by hiring an expert + the tax savings (and potentially increased investment returns) need to exceed the fees being charged.

Please schedule a time with me to discuss the value of hiring a financial advisor and see if we might be a good fit to work together.

Below is a breakdown of what's included in each service

Financial Planning (Ongoing)

✓ Portfolio / Risk Analysis

✓ Tax Planning Strategies

✓ Debt Management Strategies

✓ Roth IRA Conversion Review

✓ Insurance Planning

✓ Estate Planning

✓ Retirement Income Planning

✓ Wealth Transfer Planning

✓ Charitable Giving Strategies

✓ Collaboration with Third Party Professionals (Attorney, CPA, etc.)

✓ And MORE...

Investment Management

✓ Portfolio Review

✓ Risk Tolerance

✓ Time Horizon Analysis

✓ Investment Research

✓ Asset Allocation

✓ Low-cost Investment Selections

✓ Rebalancing

✓ Gain/Loss Harvesting

✓ And MORE...

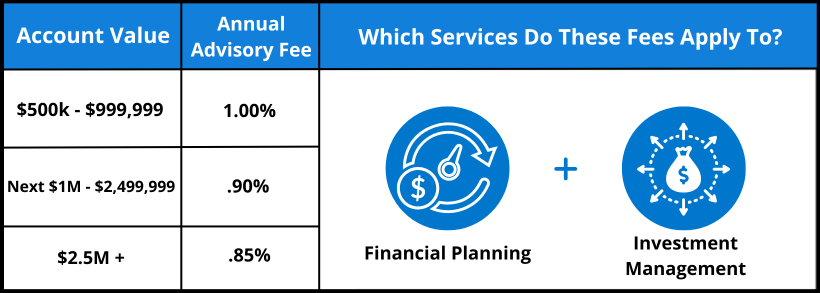

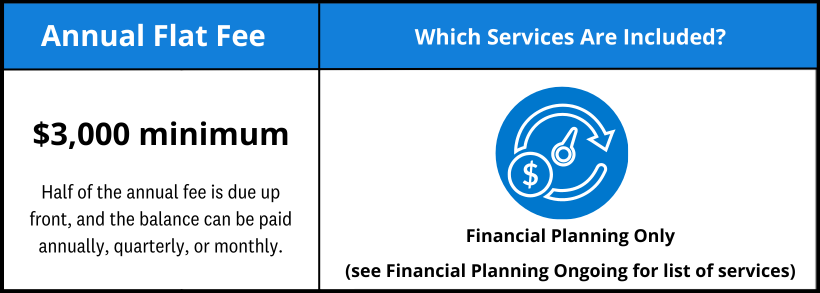

Here's how our fees are determined